#Ask It: Do You Buy Trip Insurance?

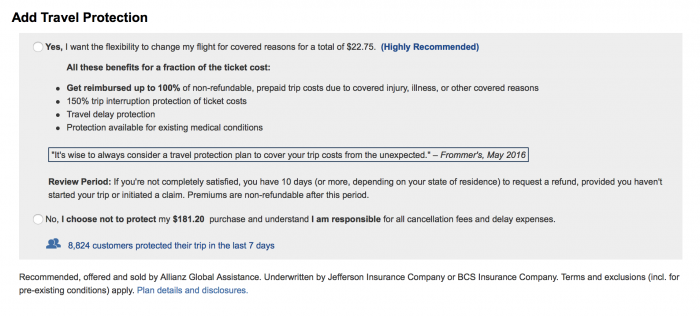

I’m following up on a great article from Tammy Whiting this week in which she listed 10 things you should know about trip insurance. These days every web site I’ve seen that sells hotels or flights asks that you confirm your choice to buy or not buy trip insurance before you complete your purchase.

I happily admit I don’t purchase trip insurance in most cases. Many of my flights are booked last minute or within a week of travel, and most hotels only charge for one night (the deposit) if at all if you don’t show up. If I were traveling with an older person, or knew my plans could change without warning, or a trip was especially expensive, I’d consider insurance. How about you?

Do you purchase trip insurance? If so, in what cases?

- No, never (47%, 74 Votes)

- Only if the trip is expensive (24%, 38 Votes)

- Other (comment) (15%, 24 Votes)

- Yes, always (13%, 21 Votes)

Total Voters: 157

Last week, we asked how you feel about the upcoming changes to Artist Point at Disney’s Wilderness Lodge. Opinions were mixed.

I purchase travel insurance for cruises or international travel only.

For trips within the US I purchase flights via Southwest and make use of their liberal cancellation policy. Disney has been nothing but accommodating when emergencies prevent travel to either Disney World or Disney Land. I haven’t found travel insurance to be necessary for those trips.

Yes. For Cruises or anything out of country.

One of the guys in our group rented a moped in St. Thomas and spun out on gravel and had to be airlifted back to Miami. Without trip insurance that would have cost many thousands.

And from my childhood…On the Emerald Seas cruise ship. My beloved Polaroid SX 70 was stolen and trip insurance covered the replacement cost.

Only for international trips, cruises, and hurricane season

We always purchase trip insurance for international and cruise vacations. Mainly for the medical coverage. On a Disney cruise two years ago, my daughter had an ear infection. Treatment in the medical center was $385. Our trip insurance of $150 covered that cost completely. We haven’t had to do any other claims on international trips., but just the thought that medical emergencies are covered makes the cost worthwhile.

For Disney with Southwest place tickets, no, I don’t. For other trips, no, I don’t…unless we’re traveling with my elderly parents as well. Then yes, I do. There’s just a greater chance we’ll need to cancel when traveling with them.

We are DVC owners. So far I have only purchased insurance for a cruise. Not for WDW trips.

Not sure if this can be bought in the US but coming from the UK we buy an annual travel insurance policy each year which covers all trips for an annual fee. We would never go on holiday without travel insurance – it’s a small price to pay to cover all those things we hope won’t happen.

I have a credit card that has trip insurance built in for things that I buy with it. I’ll use it to purchase non or not easily refundable pieces of the trip, like flights.

I prefer to use a site like Insure My Trip as opposed to the insurance offered by the airlines or travel companies. It lets you compare & customize your insurance.

The trick is the customization, which you don’t get from the generic insurance offered by the airlines or travel companies.

When traveling international I’m looking for supplemental health insurance.

On a tour or cruise I’m looking for something that will get us caught up to our tour group if we are delayed arriving.

Something special booked for early in the trip, say a special tour or something that is expensive & can’t be rescheduled/refunded I’m looking for that to be reimbursed.

Winter months I want something that will reimburse us for extra days if we can’t get home & end up spending a couple unplanned days in a hotel.

Delayed bags may or may not be an issue – if going to the beach I’m good with a bikini & toothbrush that was in my carry on for a day, but if I’m going on a running tour or hiking & need to buy replacement items I’d like that to be covered.

You get the idea… the trip really dictates if you need insurance & if so, what.

I try to buy things a la carte and fully refundable- avoiding packages as they have stricter cancellation policies. I buy insurance for non-refundable items like cruises, tours (like Adventures By Disney), vacation rentals, etc. I usually take the risk on airfare unless it is part of a cruise or tour where an airline delay could possibly put the entire trip in jeopardy.

My husband went through some medical issues a few years ago that forced us to cancel a few trips. We had trip insurance for most of them which we had just purchased on a whim as before then we didn’t normally purchase it. Now I will always purchase it. It is a very small fee in most cases and the hassle it saves you if something happens is immeasurable. When our luggage was lost going to a funeral, the insurance provided us with $500 each in reimbursable funds to buy new clothing. Life saver for sure. The only thing is now that we own DVC, I am really confused as to how trip insurance helps with DVC points and we’ve only purchased insurance for our flights in that case.

I’d say I sort of do.

If it’s a domestic trip, I don’t normally purchase insurance. I haven’t found where the cost of insurance would be worth it vs. having to eat the cost of a flight or some pre-purchased tickets. However, when I make reservations for hotels more than a couple weeks out, I will take the higher rate that allows me, in most cases, to cancel within a day. I’d say that’s sort of like getting insurance.

If I’m travelling internationally, I would add insurance. Of course that’s a huge investment, but also I’d want to have medical coverage in case something were to happen.

I purchase insurance for a cruise for everyone and only for my Mom on any other kind of trip.

Yes for cruises or international travel, no for domestic trips.

Only when I book a cruise.

For trips where I fly Southwest to Disney World, no – I don’t get trip insurance. When I stay off site (especially when I have to prepay the whole cost like on AirBnB, Homeaway, timeshares, etc…), I definitely do get trip insurance. I often book those trips far in advance for long stays and they are expensive and usually nonrefundable. I just sleep better knowing I’ve got the insurance and it’s usually a small cost in comparison to the expense of the trip.

I meant to say that I don’t get trip insurance on the flights with Southwest because there’s no penalty to change flights and I don’t get trip insurance when going to Disney World because I book room only and would only lose the deposit (which is unlikely because I would definitely reschedule).

For expensive trips months out, most especially if we are traveling out of country… most emphatically YES. (For trips down to Florida on our DVC points… no.) Besides just getting our money back if something unexpected happens (such as a heron getting sucked into a plane engine causing us to miss a cruise… true story), being in the medical field, I’ve seen families financially devastated when an otherwise young, healthy person sustains an injury in another country where health insurance does not follow. Transport back to the US alone can be ruinous, not to mention the cost of care overseas (and depending on where one is, you may not WANT to be treated overseas). And, I never buy from airlines nor the cruise line (not even Disney). I always go to an independent, reputable insurance company who will cover the entire trip, AND I pay for the ‘cancel for any cause’ benefit. We just budget an extra 10% when planning for a big vacation.

I haven’t gotten trip insurance before, but I’m usually in a party of two young/healthy adults. For the domestic trips we go on, it’s completely possible something could happen where I’d have to eat a night or two of hotel and some flight change fees, and I’ve accepted that as a trade off for not spending the money on trip insurance.

However, there are circumstances that would make me get trip insurance, like a cruise, where if something bad happens before you embark the whole trip could be gone. Or if I traveled somewhere internationally where the standard of medical care was lower than that of the US.

I ALWAYS purchase trip insurance for international trips and cruises, as medical issues and medical evacuations/transfers can cost many tens of thousands of dollars.

Be sure you think about the many things that can happen while ON the trip, not just BEFORE the trip – the majority of trip insurance only covers what happens while ON the trip, unless you purchase a Cancel For Any Reason policy.

A family member had a medical emergency on a European cruise a few years ago, spent several weeks in a hospital, and was flown home with a flight nurse. The bills would have been ruinous without trip insurance that covered those expenses.

I will purchase the insurance if I am buying a long ways out (more than 3-4 months), mainly due to the health issues that my mother has been having. If it’s just my wife, my son, and I, then no.