Same Vacation, Three Ways: Buy, Rent or Ignore DVC?

By now, you might have picked up on the fact that I have a favorite resort. Animal Kingdom Lodge is THE BEST, and you will never convince me otherwise. (Even if you all vote against it in the WDW Resort Tournament.) I also have a pretty set vacation “style”. My family likes to arrive the day after Labor Day and stay for about a week. That gives us time to visit every park and also let our kids have a recovery day or two at the resort. And we almost always rent DVC points to book our stay.

I’ve been doing a lot of wait time analysis recently. But here at TouringPlans we’re about saving you time and money. So let’s talk dollar bills. My family likes visiting WDW pretty regularly, and we like staying Deluxe. That means we should be the perfect candidates for DVC, right? Well, I’m no accountant. But both of my parents are. So I’ve got enough accountant in my blood to know I’m not going to make that big of a financial decision without crunching the numbers to see how to get the most value out of my money.

Let’s walk through the process together – just looking at costs, am I financially better off buying into DVC, renting DVC points, or ignoring the fact that DVC exists and paying out-of-pocket for my stays?

Explain the Math!

It’s about to get finance-y up in here. So break out your calculators and your personal finance textbooks that have been gathering dust since college. Or just let me talk you through it.

DVC rentals and out-of-pocket resorts stays are pretty straightforward. I pay the money now, and I vacation soon. I’m not paying years in advance to secure my reservations. So all I have to figure out is exactly what I’m paying for each stay. We’ll walk through those numbers in the sections below.

DVC membership is a whole different ball game. I make a BIG down payment now (or I get a loan from Disney) and then I pay slightly less each year in the future (annual dues) to be able to take my vacations. But here’s the deal – paying a big amount of money now isn’t the same as if I divided that same big payment over all of the different years of my contract. There’s an opportunity cost associated with giving you a lot of my money upfront. That’s why we have those pesky things call interest rates. If I loaned you $1,000 dollars today, and for 50 years you gave me back $20 each year, I’d be upset. To be fair, you eventually technically paid me back the full value. But if I had instead invested that $1000 dollars and earned 6% on it every year, I would have almost $18,500. You only gave me $1000.

DVC is a similar concept. I give them something like $30,000+ today (or I take a loan from them, which is then even more expensive, because they charge me 12% interest), and each year they “give” me back some value by letting me stay on property, as long as I’m keeping up with my annual dues. So in order to really calculate how much DVC is costing me, I need to take at least two factors into consideration:

- Future value of my down payment – this calculation considers what I could earn with my money if I didn’t give it all to Disney at once. We’ll walk through it below, but it’s basically calculating the impact of not being able to invest the money that I give Disney.

- Inflation – on the flip side, inflation means that my money is actually worth less and less as time progresses. If I have $100 in my pocket now and use it all to buy Premium Mickey Bars (which cost $6 now), that means my $100 is “worth” 16.7 Mickey Bars. Ten years from now, prices will have gone up. Let’s pretend that Disney inflation = real-world inflation (HA), which typically hovers around 2%. That means in 10 years, a Mickey Bar will cost about $10. So today, $100 is worth 16.7 Mickey Bars. In 10 years, it’s only worth 10 Mickey Bars. Might as well go for broke and buy all of the Mickey Bars today.

For each of the three scenarios, we’re going to assume that I take the same two vacations every year:

- Standard View Studio (or resort room) at Animal Kingdom Lodge from the Tuesday after Labor Day for 7 nights

- Standard View Studio (or resort room) at Animal Kingdom Lodge for 5 nights in early February, also starting on a Tuesday

Let’s crunch the numbers and see how much I’ll pay if I pay out-of-pocket, if I rent DVC points, and if I buy a DVC membership.

Paying Out of Pocket

This scenario is (generally) the most straight-forward. I research my trip dates on Disney’s site (or use a travel agent, like the lovely specialists here at TouringPlans) and figure out the best deal I can get. Sometimes there aren’t deals; sometimes there are great deals. If I have specific travel dates and a particular resort and room type in mind, there isn’t much flexibility. For my example dates, there happens to be a pretty good room-only deal for September, and no current deal for February. That’s a good representative sample. So let’s run with it.

September, 7 nights, Standard View

When I request a stay through Disney’s website, I get the average cost per night, excluding tax. If I click on the offer details, I can see the detailed price per night – in this case, weekend nights are about $30 more expensive than weekday nights.

When I request a stay through Disney’s website, I get the average cost per night, excluding tax. If I click on the offer details, I can see the detailed price per night – in this case, weekend nights are about $30 more expensive than weekday nights.

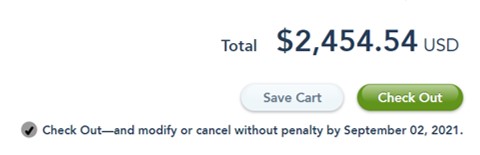

I can also go all the way to a cart and get ready to book my room to get the total cost with tax. Ah, a cool $2400 plus some change. (Just kidding – that’s eye-popping for me).

I can also go all the way to a cart and get ready to book my room to get the total cost with tax. Ah, a cool $2400 plus some change. (Just kidding – that’s eye-popping for me).

February, 5 nights, Standard View

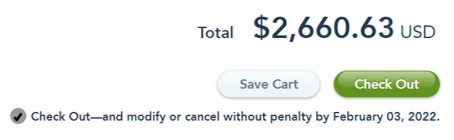

I followed the same process for my 5-night February stay, which has no current offers to make it cheaper, and get this anxiety-inducing price tag.

I followed the same process for my 5-night February stay, which has no current offers to make it cheaper, and get this anxiety-inducing price tag.

GRAND TOTAL – $5,115.17

The overall cost for just the room during my two annual vacations would be over $5,000. Ouch. Hopefully there are better options.

Renting DVC Points

This scenario is where we start getting into disclaimers. Renting DVC points is generally pretty straight-forward. You can go through a trusted broker, or work out a deal with a friend that has extra points. You pay a set amount per point and the reservation is made for you – or you purchase an already-booked reservation at a set price.

I’ve paid a wide range of different prices for DVC rentals, from $10 per point to $20 per point. If you use a trusted broker and are booking at a resort of your choosing for the dates of your choosing, it’s likely you’ll be toward the higher end of that range. For our comparison today, I’m going to use $19 per point as my rental cost because that’s generally pretty standard. Caveats apply here, though. Thanks to the lack of travel in 2020 and the ability to “bank” points from year to year, there are a LOT of DVC members that need to use up points in the coming year. Availability calendars aren’t looking great, so you might not get the exact resorts, room types, or dates that you want unless you put in some hard work shopping around. But let’s assume I did that and was able to nab my preferred rooms and dates.

September, 7 nights, Standard View

I can use Disney’s DVC point charts to figure out how many points I need to rent to cover my stay. Thankfully, September is the lowest-cost season. For a Deluxe Studio with Standard View, a full week will cost me 76 points. 76 points * $19 per point = $1,444 for my room in September.

I can use Disney’s DVC point charts to figure out how many points I need to rent to cover my stay. Thankfully, September is the lowest-cost season. For a Deluxe Studio with Standard View, a full week will cost me 76 points. 76 points * $19 per point = $1,444 for my room in September.

February, 5 nights, Standard View

My February trip will be in 2022, so I can pull that point chart and find the appropriate travel period. I’m a little further down on the list this time, which means I’m going during a slightly more expensive time of the year. I’m arriving on a Tuesday, so I’ll have 3 nights at the “SUN – THU” rate, and 2 nights at the “FRI – SAT” rate. (3*14)+(2*15) = 72 points. 72 points * $19/point = $1,368 for my room in February.

My February trip will be in 2022, so I can pull that point chart and find the appropriate travel period. I’m a little further down on the list this time, which means I’m going during a slightly more expensive time of the year. I’m arriving on a Tuesday, so I’ll have 3 nights at the “SUN – THU” rate, and 2 nights at the “FRI – SAT” rate. (3*14)+(2*15) = 72 points. 72 points * $19/point = $1,368 for my room in February.

GRAND TOTAL – $2,812

Holy. Moly. That means by putting in a little extra work by securing a rental, I’m saving 46% compared to the out-of-pocket costs. I’ll take that deal any day. But obviously the DVC members renting their points to me have to be making money too, right? So it stands to reason that if I’m renting almost 150 points per year anyway, maybe I should just buy my own.

Buying Into DVC

Are you ready for the math to get tricky?! Yeah, me too. To cover my vacation habits, I need a 150-point contract from DVC. And I’d love for it to be at Animal Kingdom Lodge so that I can book early and secure the room and dates that I want. It turns out that contracts are available at Animal Kingdom Lodge, for a down payment cost of $186 per point. If I need 150 points, that’s $27,900 to buy in. There are some closing costs on top of that (let’s say $600), and then annual dues. For 2021, annual dues at Animal Kingdom lodge are $8.08 per point.

DVC contracts do expire, generally 50 years after the resort opens. For Animal Kingdom Lodge, that year is 2057. So for my purchase price, I’m getting 150 points per year for 37 years. That’s a total bucket of 5,550 points. That sounds like a lot! And if I didn’t care about the future value of my money, that works out to ($27,900+$600)/5,550 points = $5.14 per point. Oooooh, a much better deal than renting, because my annual cost per point is just $8.08+$5.14 = $13.22, compared to the $19 I’m paying to rent. And that assumes I use all of my 150 points. If not, price per point goes up because I waste some points.

DVC contracts do expire, generally 50 years after the resort opens. For Animal Kingdom Lodge, that year is 2057. So for my purchase price, I’m getting 150 points per year for 37 years. That’s a total bucket of 5,550 points. That sounds like a lot! And if I didn’t care about the future value of my money, that works out to ($27,900+$600)/5,550 points = $5.14 per point. Oooooh, a much better deal than renting, because my annual cost per point is just $8.08+$5.14 = $13.22, compared to the $19 I’m paying to rent. And that assumes I use all of my 150 points. If not, price per point goes up because I waste some points.

But, unfortunately, I know too much! I know that I can’t just divide my down payment cost across all of the points ever. I could take that down payment and invest it and be a lot richer in 30 years. So I have to take into account the future value of my money. To do that, let’s assume two things:

- If I didn’t pay all of that money to Disney at once, I’d invest it and earn 6% every year.

- Inflation rates will stay steady at 2% every year.

That means every year, my money grows by 6% but also loses 2% of its value. We’ll call that 4% growth every year. If I evenly split my down payment and closing costs across all 37 years of my contract, I’d be paying $770.27 each year instead of $28,500 all at once. I could invest next year’s payment and earn 4% on it. I’d have $801.08 then. I could invest the payment for the year after that for 2 years before paying Disney, so I’d earn 4% for two years, and would have $833.12 for that year’s payment instead of $770.27. And so on – I can keep doing that math for each of the 37 years of my contract. In the end, if I had the opportunity to invest each year’s payment until it was due instead of paying it all at once, I’d have $62,932.81, not just $28,500. So $62,932.81 is the future value of my down payment that I’m giving to Disney.

Are you still with me?! If not, maybe I need to make a cool video with helpful animations. If so, now I can we can move on to the realistic math. The real “value” of my down payment is $62,932.81. Divide that by my 5,550 points and I get a real cost of $11.34 per point. Plus my annual dues.

Okay okay. But what does that mean for my vacation cost?

GRAND TOTAL – $2,912.89

I have 150 points. I’m only spending 148 of them, but the other 2 are a little bit lost. So either it’s a sunk cost or I get creative and find a way to spend them. Either way, annually, I’m paying $2,912.89 for my 150 points, which is a combination of the future value of my down payment and the amount of my annual dues.

What Does This Mean For Me?!

- Ignore DVC (pay out of pocket) – $5,115.17

- Rent DVC – $2,812

- Buy DVC – $2,912.89

Well, I’m definitely not paying out of pocket. No way, no thanks, not happening. If DVC rental isn’t available, I’ll downgrade to a value or moderate resort, or I’ll pick different vacation dates. The difference between rental and ownership in dollars turns out to be almost negligible once I take into account the future value of my money. Buying in would be slightly more expensive, but it comes with other perks that I didn’t factor in here. On the other hand, it would lock me in to visiting at the same frequency for decades to come. For my family, we’ll probably just keep on renting.

What Does This Mean For You?

- If you’re regularly staying at Deluxe resorts (or Moderate resorts, to be honest) and paying out-of-pocket, it’s worth your effort to at least look into renting DVC points. It’s my number one Disney money-saving recommendation to my friends and family.

- If you’re regularly paying out of pocket for Deluxe resorts for something like a week or more every year, it’s probably worth your time to look into DVC membership. Especially if renting points gives you the heebie jeebies.

- The decision whether to rent or buy DVC points likely shouldn’t be just a financial one. There are logistics and planning to be considered, etc. But money is definitely one part of it – it’s not a cheap decision. Take your time and do the math. Or have someone else do the math for you 🙂

Have you done the buy/rent math before? If you’re a DVC member, how did you make your purchase decision? Let us know in the comments!

There are so many ways to look at DVC cost. The example in your fine article takes the ownership term to the end. But how many people will own a DVC contract that long? I suggest that twelve years is a fair number of years before family life changes and the contract is sold….typically at a price high enough to make up for currency devaluation. Adding in “loss of investment profit” for twelve years plus the return of the purchase fee should work out to far less cost than renting. I like the totally bizarre approach of considering my purchase cost as an “initiation fee” that I’ll get back in the end – making my room cost equal to the maintenance fee. Deluxe rooms for about $140 a night! Thanks for a great article.

One thing that makes me feel ownership is a no brainer is that we bought 130 SSR points resale for $75 per point in 2014. Today they are going for $135-$140 per point. As long as Disney keeps increasing the cost to buy with each new resort, I expect the ability to sell these once we are Disneyed-out and be able to recoup a lot of that upfront money. We did buy 130 points Copper Creak direct for $165 and they are selling for $175-180 and this is not as much a slam dunk value. However, we could still could cash out when ever we want and make that upfront money back.

I feel the best way to do it is to buy resale when your kids are young. Use the points for 15-20 years and then cash out and rent after that as the points needed will decrease.

It is definitely more than a financial decisions. We chose to buy because it no longer required us to think about what we were doing for vacation. If you own, then you go. Reselling yearly points to renters also is helpful to offset due costs. That along with the DVC discount and perks that you receive at the resorts, it was a no brainer for us.

That base cost was a lot of why I didn’t get into DVC when I first considered it (in the ’90s I think).That and you pretty much have to go at least once every year to make it worthwhile, which I couldn’t guarantee.

It is kind of crazy, I can’t believe how much the base cost has risen since I bought into it 10 years ago. If I was looking at it now, I probably wouldn’t.

The loans directly through Disney are 10 years. After that it is just the maintenance dues. Would the math still be the same since you split the cost over the entire 37 years of the contract?

The loan has a 12% interest rate, so you end up paying much more even though you’re spreading it out over 10 years instead of paying immediately. So paying upfront is the best “value” even though it still costs you the additional money you could earn from investing it.

The one thing that could put buying DVC over renting is that if you’re going twice a year, Annual Passes (when they return) are the way to go, and the savings with the DVC discount could make the difference.

Fair point, Dave – I was only looking at room cost and excluded all other DVC-related savings. The AP impact could be a big difference-maker.

DVC purchased via the resale is much cheaper than buying DVC from Disney. I’d be surprised if that wasn’t the cheapest option among those you presented.

Disregard. Someone beat me to this comment

Personally, if it comes down to renting or buying, I believe that buying (if that is an option) is by far the better option. First, it provides you with a lot of flexibility in terms of points usage and changing hotels/dates–and as someone who has done a lot of renting points to supplement our contracts, I know you have exactly zero flexibility with most rentals. Second, in years when I don’t use the points, I can rent out enough points to cover the dues and bank the rest to beef up the next year’s trip.

Finally, buying a contract now and selling it back later works out great. DVC is the only timeshare I am aware of that increases significantly in value over the years. I made a profit on one resale contract after only three years of use. This contract came with a ton of bonus points, so I was able to get three years of awesome vacations out of it and actually come out ahead at the end. That being said, I think it makes less sense to buy if you have to finance; if you have the cash and want the deluxe Disney hotel experience though, I think it’s definitely the way to go.

So this is an interesting point, Tanya. Because we have several comments about resale being a good buyer. And also your example of resale being a good value for the seller. I wonder if the market has been shifting one way or the other.

This is a fantastic analysis as there are so many factors that go into such a large financial decision! There are two factors that are not taken into account that would be a challenge to include but might help the decision. One, the cost of the rooms will continue to increase over the next 37 years and history has told us that Disney prices will increase faster than inflation. Second, purchasing a DVC contract on the resale market will save you a considerable amount over the direct from Disney cost per point. Many times saving you 40% over buying direct from Disney. Overall it is always a personal decision but your analysis is so helpful for folks looking to take the plunge into DVC. Great job!

You’re absolutely right, Dave. Resale is certainly an option, although you will miss out on a set of perks that direct buyers get. And we ALL know Disney inflation does not equal real-world inflation. I considered including both of those things, but I didn’t want to risk turning a long and complex post into an even longer and more complex one 🙂 I appreciate you calling them out!

Your direct from Disney cost assumes there is no room discount or annual pass discount available. For a deluxe, that would typically be at least 30% reduction, so it would be about $3581 total instead of the higher figure you used. Still about $700 higher than renting points, but direct booking with Disney typically requires a smaller deposit and has a better cancellation policy, plus (during normal times) full housekeeping rather than more limited DVC housekeeping. The additional cost may be worth it to many people for the greater flexibility if their plans change.

Erica, you’re right. I did include a 25% room discount that was available for the September trip. But the only discounts I looked at were those that were available for the general public. It definitely is the way to book with the most flexibility, but does have the increased cost.

She didn’t take into account that you could potentially sell the dvc points on the resale market for a profit after using it for 25 years or atleast a break even. And this doesn’t not account for inflation. But yes I agree that the decision should on partly be a financial one.